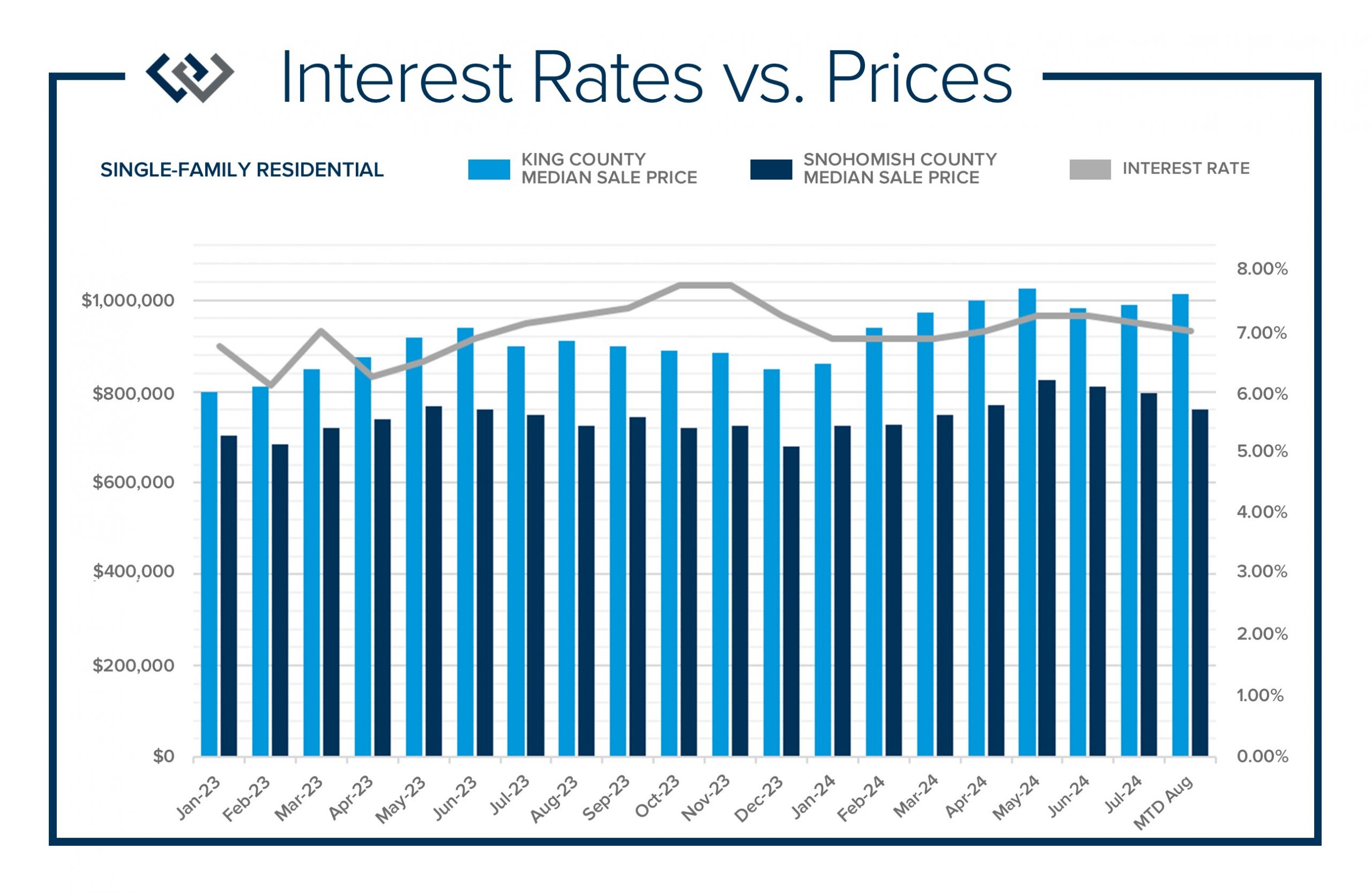

Summer 2024 welcomed an increase in available inventory, a drop in interest rates, and continued price stability, which has upheld strong home equity levels. After a double-digit ramp-up in price appreciation in the first half of 2024, prices have slightly come off the peak of May 2024 and found stability. This trend is historically consistent with seasonal patterns and nothing to be alarmed about.

Increased selection for buyers was a welcome relief as inventory was extremely tight in the spring. While there are still homes getting multiple offers and escalating, we have also seen some buyers make purchases contingent on the sale of their current home. The market has become a bit more nimble for buyer’s terms in some cases. It is important to understand the nuances of each location, product, and price point, as the environment can vary which would indicate whether a buyer would need to compete or be able to negotiate more.

These trends are coupled with rates dropping below 7% in June and they have recently sat in the mid-6%. Rates were a point and a half higher in October 2023; this is a great improvement! We anticipate rates slowly dropping further which will put upward pressure on prices. The Fed meets again this month and if rates come down even more, buyer activity will increase. Between the lower rates and higher inventory, buyers should be excited and ready to act!

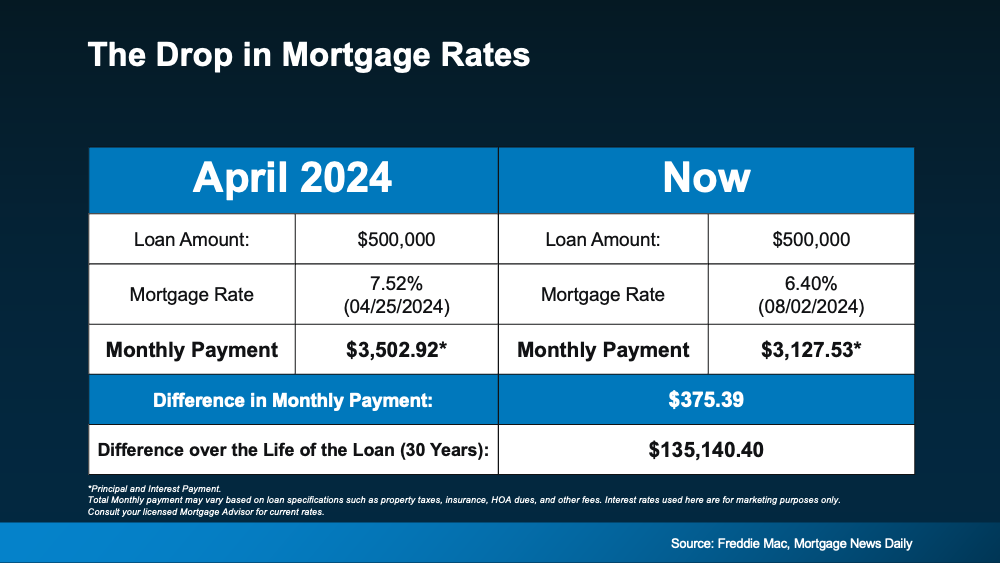

As you can see from the chart below, this shift in rate directly relates to a buyer’s monthly payment. Homes are expensive, so the cost to carry a loan is critical. These recent drops are helping out and should be paid close attention to as buyers are payment-driven in most cases. The opportunity to secure a home now with today’s rate could mean a buyer could enjoy a stable price and choose to re-finance or adjust to a lower rate later keeping their same basis. Buyers should also understand that homeownership is a key component to building wealth.

I anticipate a healthy late summer and fall market. Over the Labor Day Weekend, buyer traffic was busy despite the holiday and activity is bubbling up. The lower rates are helping some folks jump off the fence. Even some sellers are getting ready to sell and relinquish their lower rate, so they can move to a home that better fits their needs. I’m excited about the real estate market for the remainder of 2024 and into 2025. If you are curious about how the trends relate to your goals, please reach out. I am committed to staying connected and up-to-date on the latest trends so my clients make well-informed decisions.

Here is a quick update on a topic I have been keeping you up-to-date on all year. On August 17, 2024, the NAR Settlement requirements were enacted. This required significant changes to real estate practices across the country. This made big news and stirred headlines. The good news is in WA state we made the majority of these changes back on January 1, 2024, when the law surrounding buyer agency was changed.

Since January 1, 2024, we have been required to obtain Buyer Brokerage Services Agreements (BBSAs) with buyers we are providing real estate brokerage services. These agreements can be exclusive or non-exclusive, must establish clear buyer brokerage compensation parameters, have a defined agreement term, and call out whether dual agency is allowed. I have embraced these changes and have brought value to my clients through this modernized process.

Our local MLS, the NWMLS, chose to opt out of the NAR settlement in May 2024. They felt confident that the risk for exposure was low due to advancements they have been making since 2019 to elevate transparency around brokerage compensation. Their proactive consumer-focused approach along with the new WA state law have had our state ahead of the curve.

The majority of the required practice changes required by the settlement were already in place in WA state as of January 1, 2024. Due to their choice to opt out, the NWMLS will not have to comply with the requirement to not publish a seller’s offer of compensation to a buyer’s brokerage. This is confusing to all parties of a transaction and the opposite of transparency. I am proud to run my business as a member of the progressive NWMLS and under the new law established by our state on January 1, 2024.

On August 15th, 2024, the NWMLS made some slight updates to some of their forms to coincide with the final settlement details. Most notably, buyer brokerage compensation was made more clear in the Purchase and Sale Agreement. It can be connected to what the seller is offering in their listing, what is agreed upon in the BBSA, or both. Sellers can choose to offer buyer brokerage compensation, choose not to, or request to negotiate it as a term in a buyer’s offer. Depending on how the established BBSA aligns with the Purchase and Sale Agreement, the buyer brokerage compensation will be paid by the seller, buyer, or a combination of both.

If you have any questions about the settlement and all of the changes we have navigated since 2019 until now, please reach out. I am committed to providing valuable services and clear communication to the buyers and sellers I serve. I understand that purchasing and selling real estate is one of the largest financial decisions a person ever makes and it is often related to big life changes. Navigating such importance takes great skill and care and I am committed to obtaining the best results for my clients while creating an enjoyable experience along the way.

Thank you to everyone who pitched in during the Summer Food Drive! Through your generosity, we collectively donated $1,240 and 1,058 pounds of food to Volunteers of America Western Washington food banks! This is all going directly into our communities to help our neighbors in need.

Thank you!

In one year alone, 436,000 Americans die from a cardiac arrest.

In one year alone, 436,000 Americans die from a cardiac arrest.

Globally, cardiac arrest claims more lives than colorectal cancer, breast cancer, prostate cancer, influenza, pneumonia, auto accidents, HIV, firearms, and house fires combined.

Bystander CPR improves survival.

The location of Out of Hospital Cardiac Arrests most often occurs in homes/residences (73.4%), followed by public settings (16.3%), and nursing homes (10.3%). If performed immediately, CPR can double or triple the chance of survival from an out of hospital cardiac arrest.

You all know how near and dear to my heart the knowledge of CPR is. Training is coming soon! Watch for more information to follow.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link